H5000 & FallbackPOS: What retailers are implementing one year later

The Verifone H5000 malfunction is a prominent example of the consequences that can result from technical errors. In May 2022, a malfunction occurred in Verifone H5000 card payment terminals nationwide. Customers were surprised to find that they could no longer make payments at the EC terminal as usual when filling up with gas, shopping, or going to the store. Those affected had to wait several days until the malfunction was corrected or the devices were replaced, which led to dissatisfaction on the part of consumers and lost sales on the part of the companies. Today, companies can protect themselves against such and other failure scenarios by implementing a secondary, independent POS system.

- What impact can such a failure have on retail?

- How can the use of a FallbackPOS protect?

- Conclusion: FallbackPOS as preventive protection in the retail sector

What impact can such a failure have on retail?

In the case of the Verifone H5000 malfunction, most of the problems with the device have now been resolved. However, this does not lessen the impact that the disruption entailed.

The German Retail Association (HDE) surveyed 800 retail companies about the disruption, 22 percent of which were affected, including well-known brands such as Aldi Nord, Netto, dm and the Esso gas station chain. The outages lasted for several days, in many cases for more than a whole week. 83 percent of those affected had to deal with the acute situation for more than 4 days, and 70 percent said they had to do without the terminal for more than a week.

Stefan Genth, CEO of the HDE, made it clear what significance the disruption to the payment option had for customers. He emphasized that sales had been lost and customers had been extremely unsettled at times. The failures at many payment terminals thus took on dimensions never seen before and illustrated the vulnerability of complex systems to disruptive factors. Even though the affected devices have been largely replaced by Verifone, some of the EC terminals remain in use.

Today, the number of POS terminals in use in Germany is around 1.5 million, and payment by card is the preferred payment option for customers. Almost 60 percent of consumers prefer to pay by card. The expectation of being able to pay at any time without cash is correspondingly high. On average, 99.3 payments per customer per year are processed at EC terminals. Not least because of this expectation and recent prime examples of the consequences of such failures, protection against various failure scenarios, such as failed terminals or cyber attacks, is becoming increasingly important for companies.

How can the use of a FallbackPOS protect?

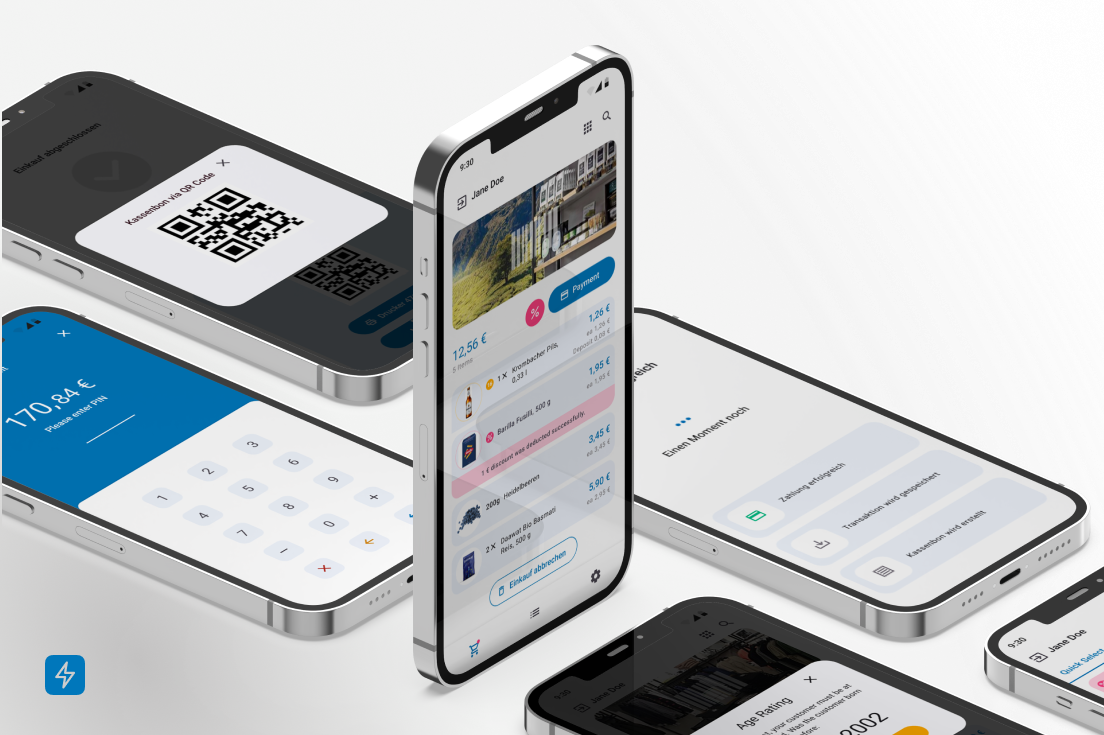

Source: Snabble

At the time, HDE CEO Genth demanded that terminal operators ensure in the future that emergency systems could safeguard against the failure of such devices. Today, merchants can take the protection against emergency scenarios into their own hands and thus have a terminal ready for payment at all times. In the meantime, new solutions are available that enable them to protect themselves against various emergency scenarios. One proven solution is the use of a fully independent and reliable secondary cash register - the FallbackPOS.

With a FallbackPOS, a mobile POS system is available that is ready for use within minutes and thus ensures ongoing business operations. At the core of the technology is the "shared nothing" architecture. This refers to the strict separation of systems. While the primary POS system is affected by a malfunction, the secondary POS system, e.g. as mobilePOS, can be easily booted up and used within a few minutes because the primary and secondary POS systems are independent of each other. Thanks to the integrated step-back function, even if data is corrupted, e.g. as a result of a cyberattack, the device can be reset to any data status and is thus ready for use.

The Snabble FallbackPOS also has its own pricing and promotion engine, which can map branch-specific prices and promotions. Receipts can be created physically or digitally, and fiscalization is also not a problem. FallbackPOS allows companies to continue operating their businesses without losing revenue or frustrating customers. Once connected, the Fallback POS system is up and running as a terminal in just a few steps, allowing errors in the primary POS system to be tracked down and corrected. In addition, the mobile POS system can also be used in regular operation, e.g. for queue busting.

Conclusion: FallbackPOS as preventive protection in the retail sector

A look at the figures on the use and distribution of EC terminals in Germany clearly shows how important it is for customers to be offered the option of paying by EC card. Affected companies have learned from the Verifone H5000 malfunction as well as other recent examples and are therefore looking for ways to protect themselves against failures that affect smooth payment transactions. A FallbackPOS as a mobile, secondary POS system offers many advantages due to its shared-nothing architecture. For example, with an emergency solution that can be implemented on existing devices, companies directly minimize several risks that go far beyond a simple technical malfunction.

More about the FallbackPOS as protection against cybercrime in retail here.

Share this

You may also like

These related stories

When the POS-System Fails: The FallbackPOS

Transforming the POS - Cloud Platform and Legacy Systems